EU Watchdogs Call For Rapid Action To Catch Up With Digital Finance

Rapid action is needed to update how cross-border financial services are scrutinised and consumers protected as the sector becomes digitalised with “Big Tech” playing an increased role, European Union regulators said on Monday.

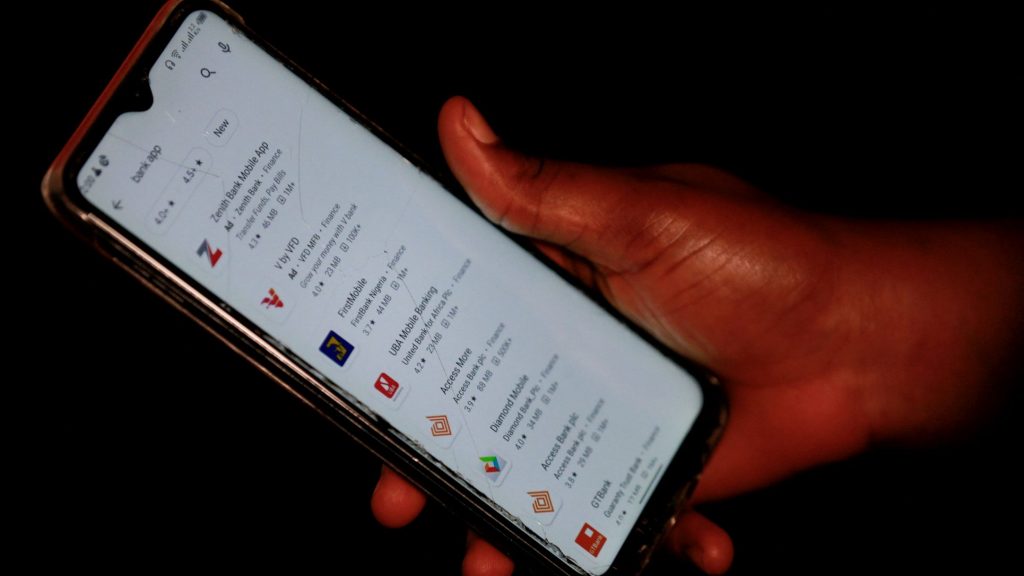

People are using smartphones to buy and sell shares, move money around bank accounts and make payments, a trend accelerated by the COVID-19 pandemic, leaving regulators playing catch-up.

“Digital finance has unlocked new synergies between financial and non-financial activities that potentially introduce systemic risk into the market for financial services,” a joint report from the EU’s banking, insurance and markets watchdogs said.

Cloud computing, or banks and other financial firms using outsourced providers for services, is booming, the report said.

(Reporting by Huw Jones; Editing by Toby Chopra)